FIFO (First In, First Out) calculates the cost of sales where goods acquired first by a company are considered the first to be sold. This approach reflects the cost of older stock , with remaining stock valued at more recent costs.

FIFO costs are calculated at the point of sales order entry.

Example of FIFO Costing Method

You purchase 10 units of a product at £12 each.

Later, you purchase an additional 8 units at £14 each.

This gives a quantity of 18 units in stock.

You sell 6. The cost price is calculated as 6 units × £12 = £72.

You sell the remaining 12. The cost for these is calculated by applying the earliest cost first: (4 units × £12) + (8 units × £14) = £48 + £112 = £160.

Setting Up FIFO

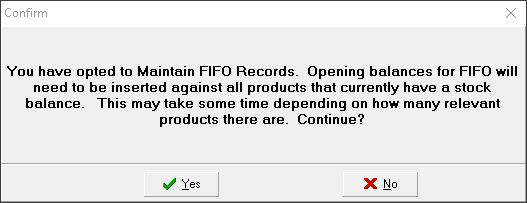

- Select the option Maintain FIFO records (in Company Set-up > Settings > Yes / No Options > Accounting). The system will automatically create FIFO opening balances based on current stock quantities. These balances are marked with a new FIFO transaction type and can be viewed on the Stock Card

- Set the costing method for:

, and/or

Product, overrides catalogue, overrides company. You will always want to set a company costing method. Use the other costing settings for specific costing situations.

Using FIFO

For all costing methods, the cost for each detail line is used to calculate the cost of sales, and therefore profit.

On the Stock Card, on the FIFO tab, a list of FIFO transactions is shown.

You can Verify if the transactions match the Current stock. If there are issues, an adjustment can be made, either increasing the FIFO quantity by adding (using the Last cost), or decreasing existing FIFO records.