Note: From 4.61, import definitions are stored in your database, not a file. Before editing a definition, or loading a catalogue, you must load your catalogue definitions into the database.

You can edit an existing definition or create a new one. New definitions can be based on existing ones.

- From the Utilities menu, click Define Import. The Define Import window opens.

- From the Import Definition list, select the import definition you want to edit or base a new definition on. The Define Import window now contains the values from the import definition.

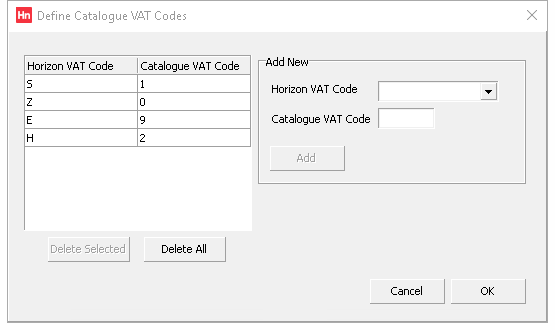

- Scroll down to VAT Code Map. If the import definition has no configured VAT code mappings, then the button will read Zero Set. Otherwise, it states how many columns have been configured. Click the button and the Define Catalogue VAT Codes window opens.

- In the Add New group, select a Horizon VAT Code and its corresponding Catalogue VAT Code.

- Click Add.

- Repeat Steps 4 and 5 until the mappings are added to the list.

- Click OK.

- To update the import definition, click Save.

Example

Data Services Portal catalogues have four VAT codes which need to be mapped to a Horizon VAT code.

After ensuring all the VAT codes are created in Set-up > VAT, the import definitions:

- +ECiDataServices UK Catalogue Import

- +ECiDataServices UK Catalogue Import Short Desc

- +ECiDataServices IRE Catalogue Import

should include the following mappings:

| Description | Catalogue VAT Code | Horizon VAT Code |

|---|---|---|

| Zero rated | 0 | Z |

| Standard | 1 | S |

| Reduced | 2 | H |

| Exempt | 9 | E |

Although the VAT rates are different, both HMRC and Revenue use similar descriptions. For current VAT rates, see HMRC and Revenue.

Note: The ECI Standard UK Catalogue Import, ECI Standard IRE Catalogue Import and ECI Standard UK Catalogue Import (Short Description) are managed by ECI, and have these VAT code mappings included.