To edit an existing VAT rate:

- On the Set-up menu, click VAT.

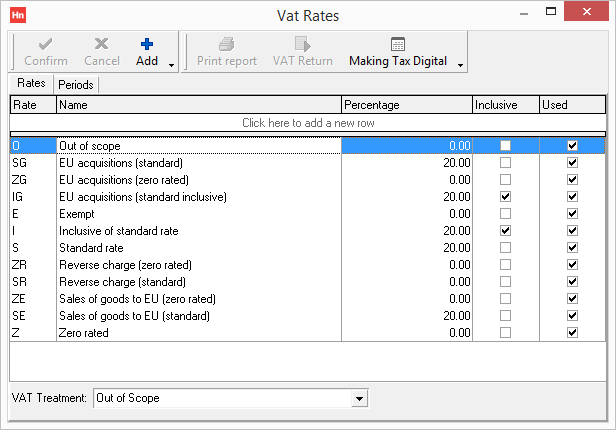

- Click the Rates tab.

- Find the VAT rate line you want to edit, and click the box you want to change.

- You can edit one or more of the following:

- Rate code – A one or two character code that identifies the VAT rate, e.g. S.

- Rate Name – A name to identify the VAT rate, e.g. Standard.

- Rate Percentage – The VAT rate e.g. 20.

- Inclusive – select if the rate is an inclusive rate.

- Used – select if the rate is in use. Clear to put the rate out of use.

- In the VAT treatment list, click the VAT treatment that applies to the rate.

Note: Selecting the wrong VAT treatment will change which transaction detail lines contribute to which box of your VAT return. The wrong VAT treatment will make your return incorrect.

- Click Confirm.

Note: VAT rates will be set up during the implementation of your Horizon system and will rarely change. Making changes can stop orders being received by suppliers.