To create a new VAT period:

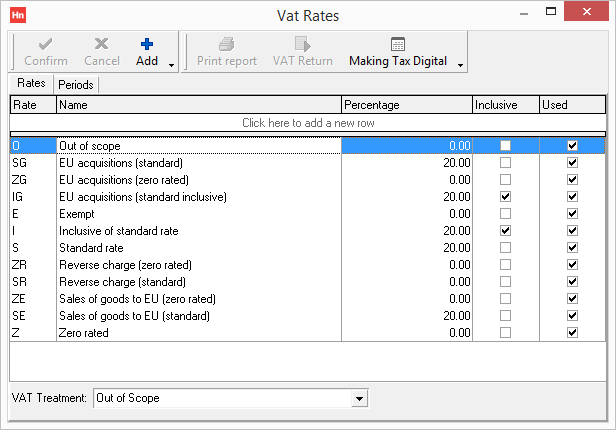

- On the Set-up menu, click VAT.

- Click the Periods tab.

- Click Add. A new line is added to the top of the Rates table.

- Type the following:

- Details – Type a name for the VAT period, e.g. 2019 Q1

- Start date – select a date from the calendar

- End date – select a date from the calendar

- Active – select to allow transactions to be created with or posted to the period.

-

Click Confirm.

Note: There are restrictions on the dates you can select:

You cannot create a VAT period with a start date after the end date.

When creating a period, you cannot leave a gap between a previous period and your new one, e.g. 2019 Q1 finishes on 31 March 2019, so 2019 Q2 must start 1 April 2019.